By Michael Shepardson, Partner, Florida CFO Group

In Part 1 of this series, we explored the basics of debt financing, like sizing the appropriate amount, understanding repayment plans, and managing lender expectations. In Part 2, we’re going a layer deeper by examining the two fundamental types of debt: secured vs. unsecured. Understanding the difference between them will help you navigate interest rates, lender negotiations, and collateral requirements with far greater confidence.

Whether you’re funding growth, bridging cash flow, or acquiring assets, the type of debt you choose matters just as much as the amount.

What Is Secured Debt?

Secured debt is backed by collateral, an asset your lender can claim if you default. Because the lender takes less risk, secured debt often offers:

- Lower interest rates

- Larger loan amounts

- Longer terms

Common examples:

- Equipment Loans:Provided by an equipment lender as a purchase money loan or a bank with a lien on the purchased equipment among other assets.

- Asset-Based Lines of Credit (ABL):Backed by inventory and/or accounts receivable with a higher level of collateral monitoring (Daily, weekly, monthly, or quarterly).

- Commercial Real Estate Loans:Made to purchase a specific property or properties that also serve(s) as collateral.

What Is Unsecured Debt?

Unsecured debt does not involve the use of a borrower’s assets as collateral. Approval is based more heavily on the company’s cash flow, credit history, and overall operating strength, such as consistent margins and a strong balance sheet.

Because lenders face more risk (since they have no collateral to liquidate when a company’s financial condition deteriorates), unsecured loans typically come with:

- Higher interest rates

- Shorter repayment periods

- Lower maximum loan amounts

Examples include:

- Business credit cards

- Cash Flow-based financing

- Term loans from fintech lenders

- Some SBA Express loans

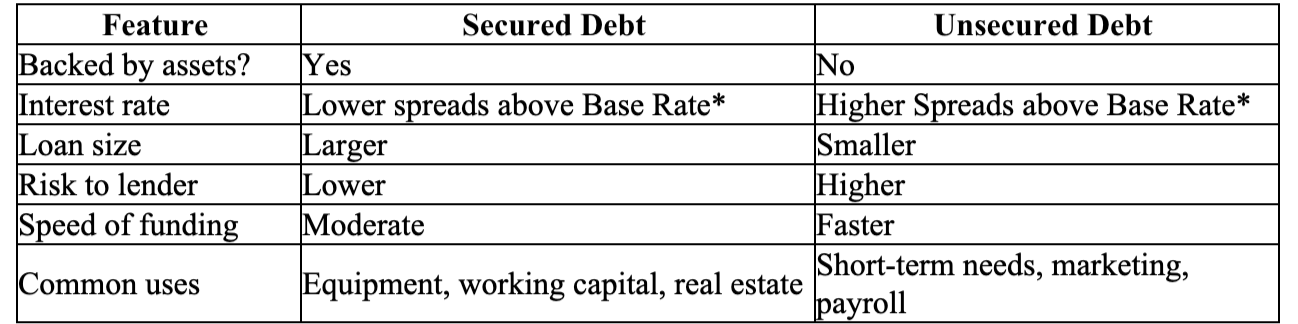

Secured vs. Unsecured Debt: A Simple Comparison

*Base rate typically refers to Prime Rate, LIBOR, or SOFR

What Can Be Used as Collateral in Secured Debt?

Lenders usually accept "hard assets"that they can quickly value and liquidate. Typical collateral includes:

- Cash-based instruments (CDs, Treasuries, pledged Cash accounts)

- Accounts Receivable

- Inventory

- Equipment

- Commercial Real Estate

- Vehicles

- Personal Guarantees (if corporate assets fall short)

The more reliable the asset—meaning it has a clear value and can be quickly converted to cash—the more favorable the loan terms are likely to be.

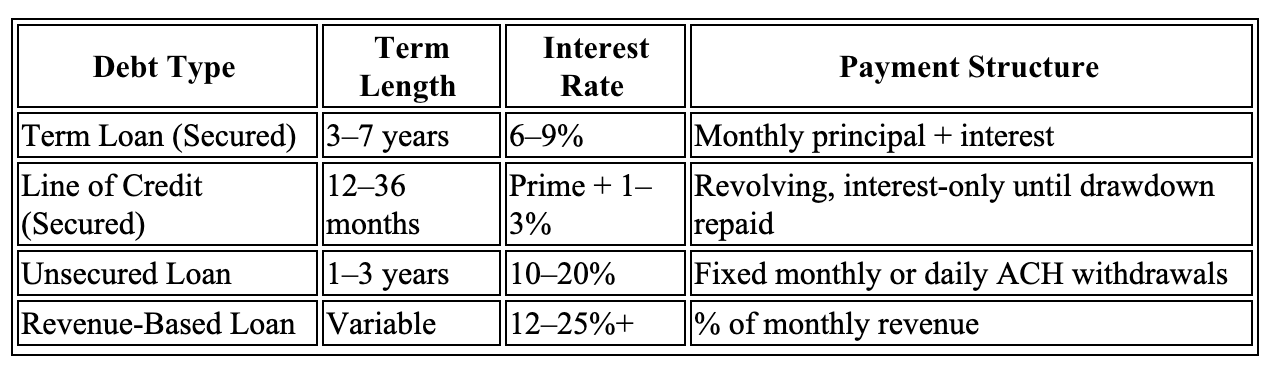

Typical Repayment Plans and Terms

Watch out for:

- Balloon Payments:A large lump sum due at the end

- Prepayment Penalties:Common in early payoff of term loans

- Interest-Only Periods:Great for cash flow in early months

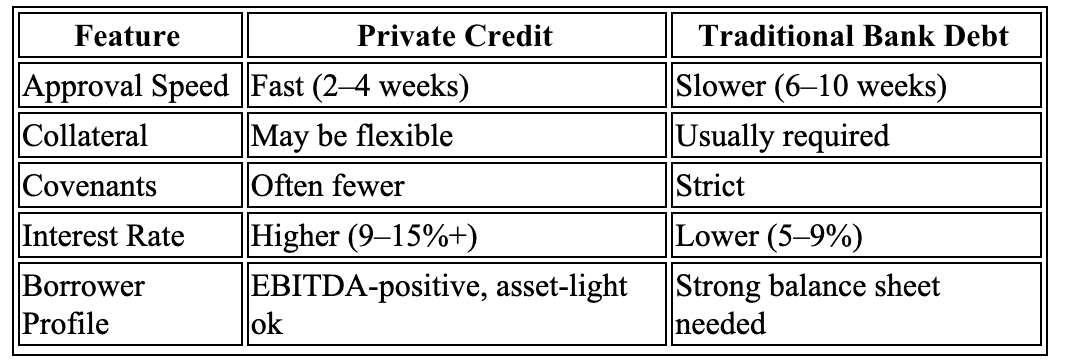

The Rise of Private Credit: A New Option

Following the 2008 financial crisis and the implementation of the Dodd-Frank Act, banks reduced their lending to riskier borrowers, particularly small businesses. Into that void stepped private credit funds, non-bank lenders funded by institutional investors (pensions, endowments, etc.).

These firms now provide over $1.5 trillion in financing to businesses that might not meet traditional bank requirements.

Well-known private credit players include:

- Ares Capital

- Blackstone Credit

- Owl Rock (Blue Owl Capital)

- Golub Capital

Private Credit vs. Traditional Bank Loans

It’s Not Just the Loan—It’s How You Structure It

Debt can be a highly effective tool when structured appropriately. Understanding the type of debt you’re using, the risk you're taking, and the cost of capital is essential to scaling effectively.

If you're unsure whether a secured, unsecured, or private credit solution is the best fit, Florida CFO Group partners are strong strategic advisors who can assist you in matching structure to strategy.

About the Author

Michael Shepardson is a partner with The Florida CFO Group. The Florida CFO Groupis a seasoned team of over 30+ Chief Financial Officers providing fractional (part-time) and interim CFO services to small- and medium-sized businesses (SMBs). Michael specializes in providing fractional CFO, M&A advisory, and exit planning services to companies with $10M–$150M in revenue by helping business owners structure capital, improve cash flow, and prepare for strategic growth or exit.

He can be reached at michael.shepardson@floridacfogroup.com

Contact Us

If you have any questions or would like to discuss your organization’s finance and strategic management needs, please call the Florida CFO Group at 1-877-352-2367 or send us a message. We are here to help you navigate your financial challenges and achieve success!

If you missed Part 1 of this series, you can read the article here.