Every business should have Performance Metrics (also called Key Performance Indicators or “KPIs”) to provide objective measurement of how the business is performing. Businesses need meaningful metrics that offer business leaders insight not only into how the business is performing overall, but into the underlying health of the business and any changes therein. Meaningful metrics are invaluable in alerting management to favorable as well as unfavorable trends taking place, and allowing time for appropriate actions to be taken. Some meaningful metrics to consider in our current economic environment where the potential for a recession exists are Efficiency Ratios. These ratios measure how efficiently a company uses its assets to generate revenue and its ability to manage those assets. Companies that are more efficient with their resources are often more profitable as well.

Efficiency Ratios include the Inventory Turnover Ratio and the Accounts Receivable Turnover Ratio.

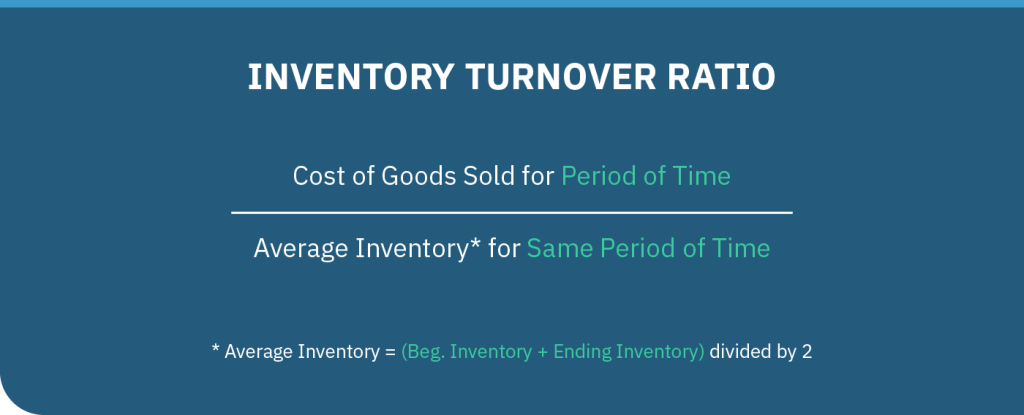

Inventory Turnover Ratio. The Inventory Turnover Ratio is calculated by dividing cost of goods sold by the average inventory for the same period.

The higher the ratio the better, as it indicates the company is able to sell goods quickly. This reduces working capital requirements, inventory carrying costs, and risk of obsolescence. A declining Inventory Turnover Ratio should be analyzed to determine the cause(s) as it could forebode important changes in the business, such as inventory obsolescence or economic slowdown, and allow business leaders to act more quickly.

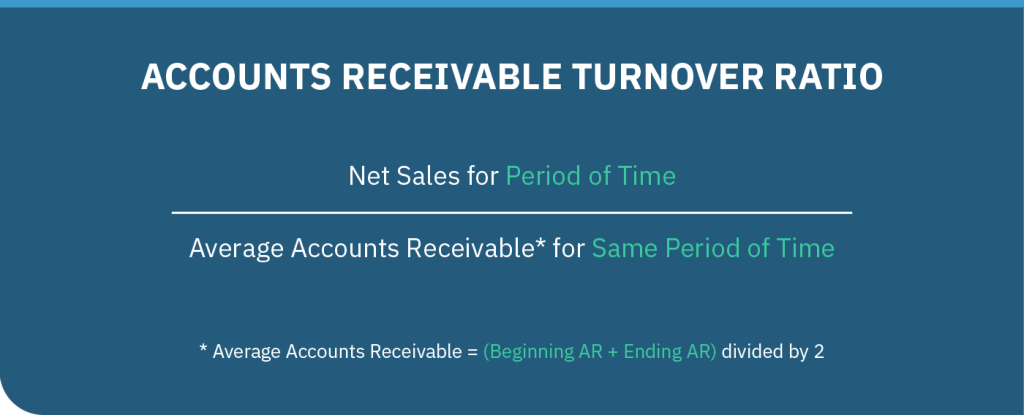

Accounts Receivable Turnover Ratio. The Accounts Receivable Turnover Ratio is a metric that measures how effectively the business collects its accounts receivable. This ratio is calculated by dividing net sales by average accounts receivable where net sales is sales on credit minus sales returns and minus sales allowances.

This metric is commonly used to compare companies within the same industry to determine if they are performing better or worse than their competitors. Lower or declining Accounts Receivable Turnover Ratios should be analyzed to allow business leaders to adjust credit policies more quickly when economic slowdowns affect the business. In addition, such an analysis will allow management to maintain adequate bad debt reserves and minimize write-offs of uncollectible accounts receivable.

With the potential for recession looming, businesses that continually monitor the performance of their inventory and accounts receivable will be able to adjust more quickly and minimize any negative impact of an economic slowdown.